Franklin India Dynamic Asset Allocation Fund of Funds-Growth

(Erstwhile Franklin India Dynamic PE Ratio Fund of Funds-Growth)

Fund House: Franklin Templeton Mutual Fund| Category: Fund of Funds-Domestic-Hybrid |

| Launch Date: 31-10-2003 |

| Asset Class: Mixed Asset |

| Benchmark: CRISIL Hybrid 50+50 Moderate Index |

| TER: 2.01% As on (30-06-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 5000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 1,324.89 Cr As on 30-06-2025(Source:AMFI) |

| Turn over: - | Exit Load: In respect of each purchase of Units - • NIL Exit load – for 10% of the units upto completion of 12 months. o The “First In First Out (FIFO)” logic will be applied while selecting the units for redemption o Waiver of Exit load is calculated for each inflow transaction separately on FIFO basis and not on the total units through multiple inflows o The load free units from purchases made subsequent to the initial purchase will be available only after redeeming all units from the initial purchase • All units redeemed /switched-out in excess of the 10% load free units will be subject to the below mentioned exit load. o 1.00% - if Units are redeemed/switched-out on or before 1 year from the date of allotment o Nil - if redeemed after 1 year from the date of allotment |

165.5969

-0.2 (-0.1211%)

13.8%

Benchmark: 11.41%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

AK Hybrid Balanced TRI

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

2 Years 3 Months

6 Years 11 Months

10 Years 5 Months

17 Years 9 Months

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

The Scheme intends to generate long-term capital appreciation and income generation by investing in a dynamically managed portfolio of equity and debt mutual funds.The equity allocation [i.e. the allocation to the equity fund(s)] will be determined based on qualitative and quantitative parameters. There can be no assurance that the investment objective of the scheme will be realized.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 7.1 |

| Sharpe Ratio | 1.6 |

| Alpha | 7.07 |

| Beta | 0.55 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

Scheme Characteristics

Minimum investment in the underlying fund - 95% of total assets.

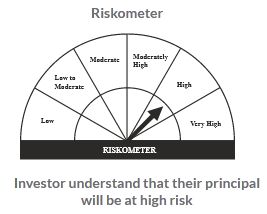

Riskometer

PORTFOLIO

Market Cap Distribution

Others

100.0%